Great Lakes Educational Loan Services, better known as GreatLakes student loans, is one of the most recognizable names in the U.S. when it comes to managing student loan debt. A major federal student loan servicer, Great Lakes has assisted millions of borrowers in managing repayment plans, keeping track of balances, and meeting their financial obligations. Understanding how Great Lakes loans work is the first step to navigating student loans and making smart repayment choices.

In this article, we’ll walk you through everything you need to know about GreatLakes student loans, including managing your account, repayment options, forgiveness programs and more.

What are GreatLakes Student Loans?

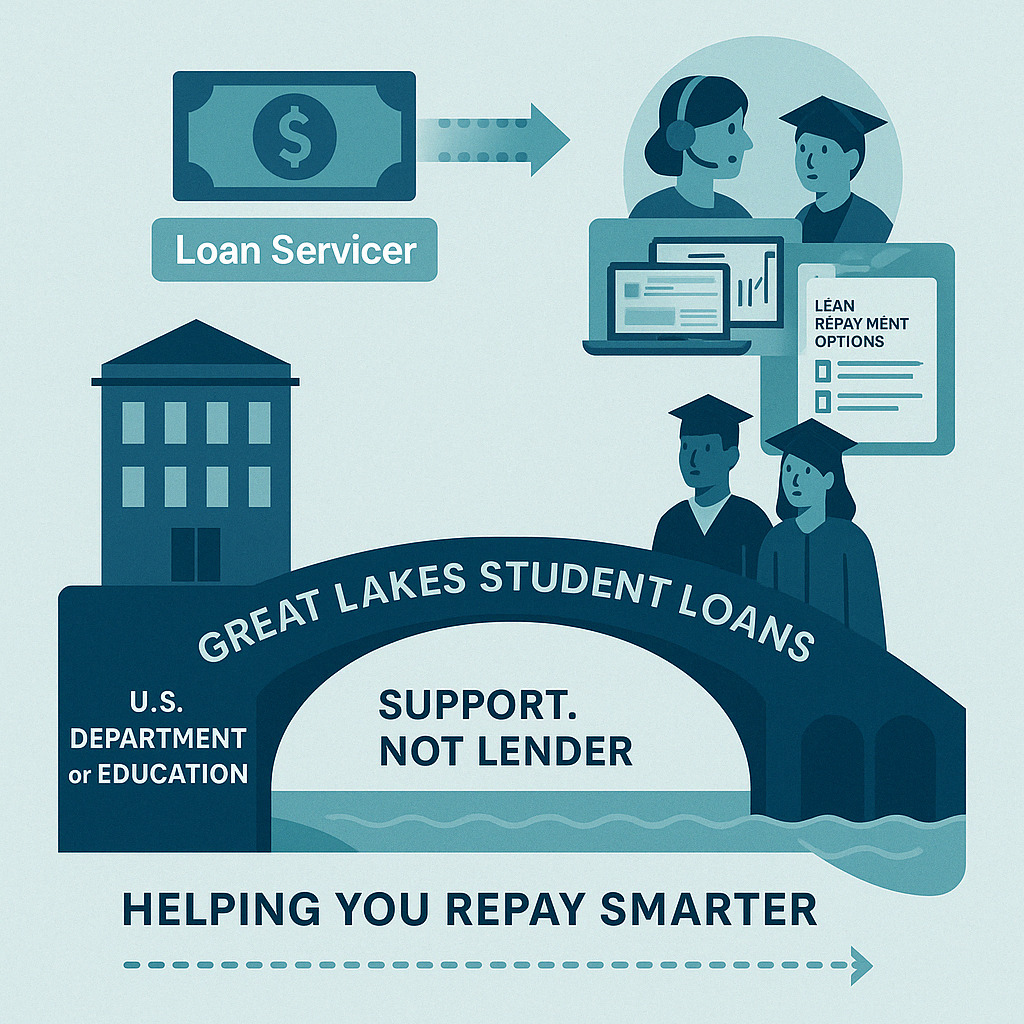

These student loans are federal loans serviced through Great Lakes Educational Loan Services, Inc. As a loan servicer for the U.S. Department of Education, Great Lakes serves as an intermediary between borrowers and the federal government. They do not provide loans but oversee the repayment of the loans.

If you borrow a federal student loan, it might be assigned to Great Lakes for servicing. Great Lakes will send you your monthly statements, process payments and any future changes to your repayment plan.

Great Lakes loans serviced

It’s services multiple types of federal student loans, including:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans (for parents and graduate students)

- Direct Consolidation Loans

- Loans from the Federal Family Education Loan (FFEL) Program (older loans)

They all have their own unique features and repayment terms, but they can all be managed from your Great Lakes loans account.

How To Log into Your Great Lakes Student Loan Account

The company’s secure online portal makes it easy to manage your GreatLakes student loans. To get started:

- Visit mygreatlakes.org

- Sign up or sign in to your account

- See your loan balances, interest rates, payment due dates, and repayment options

An online dashboard is intuitive, allowing you to set up auto-pay, make one-time payments or look into deferment and forbearance options if you’re struggling to make payments.

Repayment Terms for Great Lakes Loans

If you have Great Lakes loans, one perk is that you can choose from various repayment plans that work for you. These include:

- Standard Repayment Plan: 10 years of fixed payments.

- Graduated Repayment Plan — Payments start low and rise every two years.

- Extended Repayment Plan: Payments up to 25 years, either fixed or graduated.

- Here are all plans that go on Income-Driven Repayment (IDR) Plans:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Plan 1 Income-Contingent Repayment (ICR)

Every IDR plan determines your monthly payment based on your income and family size, making it easier on borrowers who have lower incomes.

Options for Loan Forgiveness and Cancellation

Most borrowers with GreatLakes student loans may be eligible for loan forgiveness programs. There are many, but some of the most common include:

- Public Service Loan Forgiveness (PSLF): For borrowers with qualifying nonprofit or government jobs who make 120 qualifying monthly payments under any IDR plan.

- Teacher Loan Forgiveness: Up to $17,500 forgiven if you’re an eligible teacher teaching in low-income schools.

- Total and Permanent Disability Discharge: For borrowers with an eligible disability.

- Closed School Discharge: When your school shuts down while you’re enrolled, or soon after you leave.

Note only federal loans are eligible for these programs, and borrowers must satisfy all requirements.

Great Lakes Loans Customer Service Contact Information

But if you have questions or need assistance managing your loans, you can reach Great Lakes loans customer service through these channels:

- Phone: 1-800-236-4300

- Online Chat: Via your online account

- MAILING ADDRESS: GREAT LAKES EDUCATIONAL LOAN SERVICES, INC.

- P.O. Box 7860

- Madison, WI 53707-7860

The customer support team can help with issues related to payment processing, updating contact information, and discussing repayment or deferment options.

Reasons Why Great Lakes Should Be Your Loan Servicer

Some of the most important benefits for borrowers with GreatLakes student loans include:

- Easily walk-through levels of loan management

- Payment methods when you might be eligible for interest rate discounts

- Resources for financial literacy and repayment approaches

- Tailored advice about loan forgiveness and repayment options

These tools help you keep track of payments as well as provide an opportunity to avoid default.

Transitioning from Great Lakes to Nelnet

The U.S. Department of Education has been slowly phasing out certain federal loan servicing contracts in recent years. In 2022, Great Lakes formally handed over all federal student loan accounts to Nelnet, another major federal loan servicer. This transition means that:

- Borrowers now log in to Nelnet. com instead of mygreatlakes. org

- Totals for accounts, balances and history were automatically rolled over

- Any payment and IDR plan data moved with your account

If your loans were serviced by Great Lakes, you would have been communicated with about the transfer. If you manage your Great Lakes loans through the organization, it’s important to create a Nelnet account (if you haven’t done so already) in order to keep managing your loans without interruption.

Instructions for Managing Your GreatLakes Student Loans

Whether you’re still with Great Lakes or have been switched to Nelnet, these tips can help you stay ahead of your student loan repayment:

- No missed due dates when you set up automatic payments and they sometimes offer interest rate reductions.

- Look into IDR plans if you have a high payment.

- Monitor your qualified time for any loan forgiveness programs such as PSLF.

- Make sure your servicer has your contact information.

If you can, make additional payments to pay down your balance sooner and pay less interest.

Conclusion

For years, GreatLakes student loans have been a trusted avenue for borrowers to manage federal student loan debt. Even though the bulk of servicing on these loans has moved over to Nelnet, knowing how Great Lakes loans functioned — and how to manage them properly — remains extremely relevant for millions of borrowers.

Understanding Updated Repayment and Forgiveness Programs & Using Tools To Help Keep Your Student Loans In Check This Bringing all back to you – staying informed, utilizing free, online tools available to help you stay in check to explore what repayment and options for forgiveness in place that you can use to your benefit to help empower your savings to apply towards your future financial goals plans! Whether you’re entering repayment for the first time or trying to get your loans forgiven, handling your loans through Great Lakes (or Nelnet) can be relatively painless once you know how it works.